Shaping the New Space Economy

Market leaders know: 200-600 kg satellites are no longer just “miniaturized alternatives” but the beating heart of the commercial space revolution. In Turin, Space Industries is about to start its serial-production satellites up to 700 kg in a scalable, high-tech cleanroom facility. Why this mass range, and what does it mean for our clients, customers, and partners? Let’s break it down.

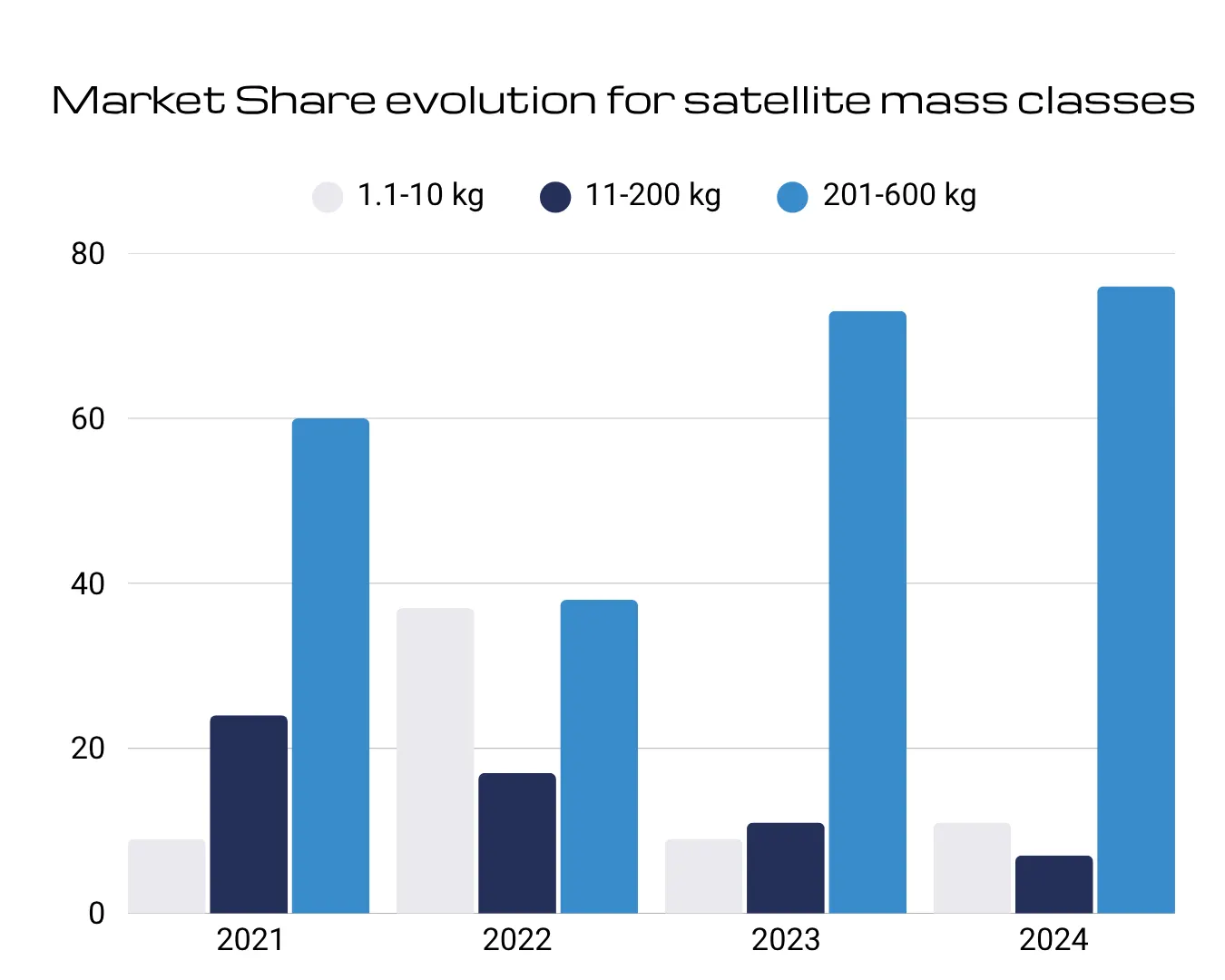

Market Share: A Dramatic Shift Toward Mid-Mass Platform

The numbers couldn’t be clearer. In 2024, 76% of all small satellites launched worldwide were in the 200-600 kg range, up from just 9% the year before. This is the direct effect of mega-constellation deployments (Starlink, OneWeb) and shifting commercial priorities, as operators require more onboard power, higher resolution, and longer satellite lifespans without spiraling costs.

Figure 1 – Market share evolution for satellite mass classes, 2021–2024. Data: BryceTech, NASA, industry reports¹

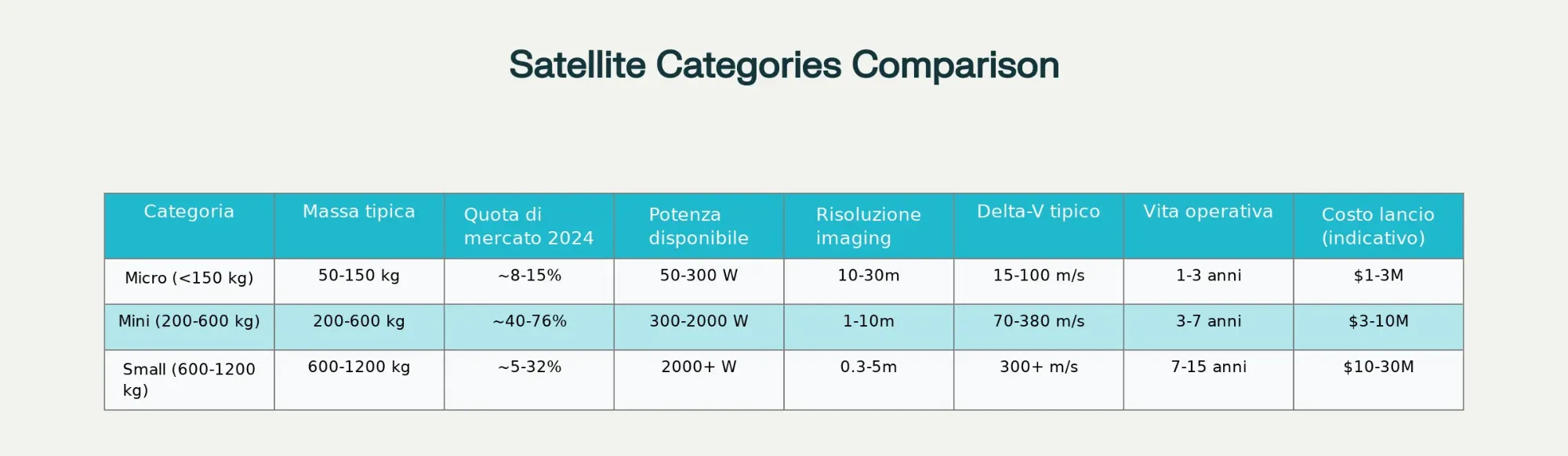

Why 200–600 kg? The Business Sweet Spot

Satellites in this range represent a genuine “sweet spot” between capability and cost:

- Performance: 3–7x more electrical power than micro/nano satellites, supporting more advanced sensors and real-time payloads.

- Longevity: Typical lifespans reach 3–7 years, outpacing smaller satellites and reducing replacement costs.

- Launch Efficiency: Well-suited for rideshare and batch launches at sharply reduced prices, driven by the commercial space boom.

Figure 2 – Satellite Class Comparison: Mass, performance, and costs. Mini-satellites (200–600 kg) combine extended lifespans, higher power, and superior imaging versus micro/nano-sats²

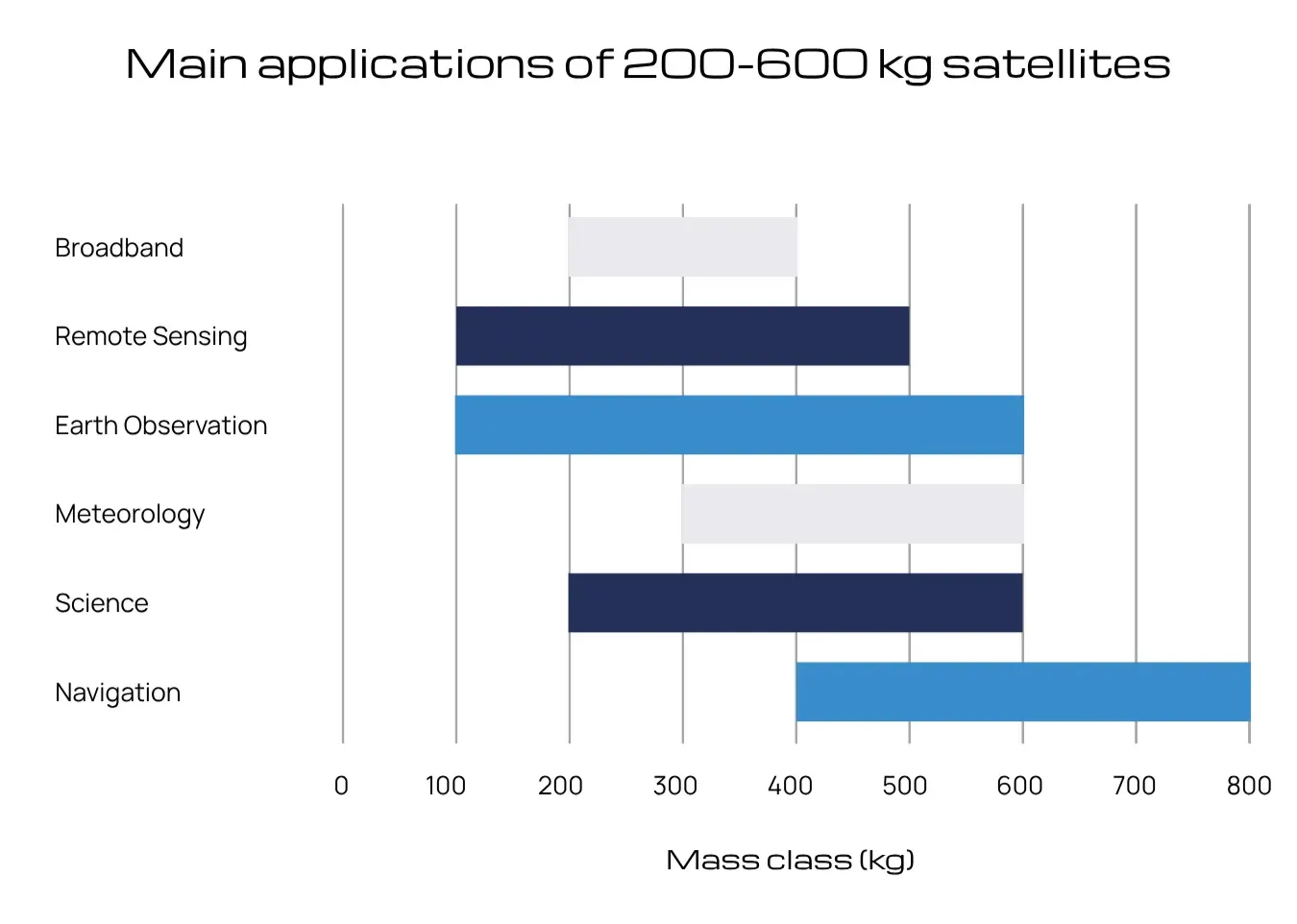

Application Focus: Going Beyond Communications

While mega-constellations for global broadband have stolen headlines, 200–600 kg satellites unlock much more across industry verticals:

- Broadband Constellations: (200–400 kg) Powering global internet coverage and direct-to-device communications.

- Earth Observation: (100–600 kg) Delivering high-res, low-latency imagery for agriculture, urban planning, environmental monitoring.

- Meteorology: (300–600 kg) Supporting advanced weather tracking with multi-sensor payloads.

- Remote Sensing & Science: (100–500/200–600 kg) From climate studies to disaster monitoring and basic research.

- Navigation/Positioning: (400–800 kg) Extending GNSS and high-precision timing coverage

Manufactufing at a Scale: The Serial Production Revolution

The new playbook isn’t just in orbit: it’s on the factory floor. Space Industries’ state-of-the-art, 2,000 sqm Clean Room (expandable to 3,500 sqm) exemplifies the move from bespoke craft to batch production, with sharply reduced lead times and high-volumes.

- Cost Control: Mega-constellation leaders like OneWeb have driven unit prices down to around $1M per satellite, including launch, through industrial processes and assembly lines.

- Repeatability: High throughput (e.g., 140 satellites per year) ensures fast refreshes and scalability for growing operator needs.

Looking Ahead: Scaling Missions, New Orbits

With the proliferation of mid-mass satellites, doors are opening to new markets: MEO/GEO missions, lunar relay networks, and the emerging in-orbit services segment-inspection, repair, and debris management. As constellations scale toward tens of thousands of satellites, sustainable, modular platforms in the 200–600 kg range are set to dominate.

- Cost trajectory: SpaceX rideshare pricing, now around $6,500/kg to SSO, is unlocking new levels of accessibility³.

- Technology jumps: Antennas are evolving rapidly, with phased arrays and high-throughput payloads designed for these power budgets⁴.

- Service expansion: Operators eye on-orbit servicing and next-gen networking—all dependent on scalable, robust platforms.

👉 Follow Space Industries on LinkedIn to discover how we’re transforming Italy’s industrial legacy into the engine of the new Space Economy.